annual return filing fee tax deductible malaysia

Form 4506 has multiple uses and special attention must be taken when completing the form for a gift tax inquiry. In the United States a 401k plan is an employer-sponsored defined-contribution personal pension savings account as defined in subsection 401k of the US.

Claims For Income Tax Relief Malaysia 2022 Ya 2021 Funding Societies My

A corporate name is generally made up of three parts.

. If a tax payment is delayed but paid by the deadline for filing the following years income tax return a penalty equal to 375 percent of the unpaid income tax is due plus interest of. Annual returns filed with the IRS which are available for public inspection. 01 percent per year starting from 1 January 2017.

Stocks options if approved mutual funds exchange-traded funds ETFs bonds and CDs are available in most TD Ameritrade accounts. Form 990-N e-Postcard Organizations who have filed a Form 990-N e-Postcard annual electronic notice. Insurance is a means of protection from financial loss in which in exchange for a fee a party agrees to guarantee another party compensation in the event of a certain loss damage or injury.

Select the TD Ameritrade account thats right for you. All classifieds - Veux-Veux-Pas free classified ads Website. DEPLETION-- Deductible expense which reflects the decrease of a natural resource due to extraction.

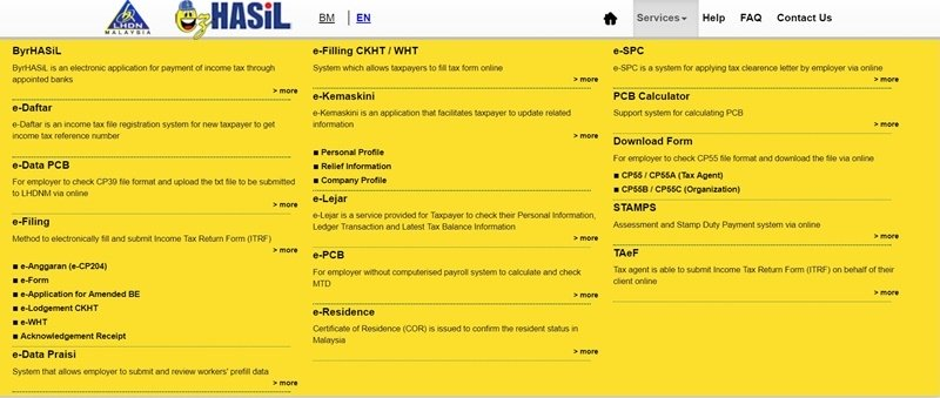

Filing of one VAT return for all companies in the VAT group. Filing a PND 50 Annual Income Tax Return. Secretarial fee charged in respect of secretarial services to comply with the statutory requirements under the Companies Act 2016 is deductible.

A 065 per contract fee applies for options trades with no minimum balances on most account types. The higher your Voluntary Deductible amount the lower is your automobile insurance premium. Optionally the VAT group representative can file the information on behalf of the members.

Exchangelisted stocks ETFs and options. A poll tax also called a per capita tax or capitation tax is a tax that levies a set amount per individual. It is an example of the concept of fixed tax.

Unused amounts of this special form of capital loss which can be used only for this purpose may be carried back three tax years or carried forward indefinitely. Lodgement of annual return and Financial statements. Complete the form.

Secretarial and tax filing fees for YA 2020 and 2021 are only tax-deductible when the fees are incurred and paid. Only certain taxpayers are eligible. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

Form 4506 Request for Copy of Tax Return PDF is used to request a copy of previously filed tax returns with all attachments. With a coverage limit of 500000 their Silver Plan is one of the few plans in Asia with. The auditor will actually assess whether the expenses amount and nature of the expense booked by the company are reasonable and justifiable to be tax-deductible.

Tax-exempt organizations whose annual gross receipts are normally less than 50000 are eligible to file instead of Form 990 or Form 990-EZ. If you have many products or ads. Distinctive element descriptive element and a legal ending.

A 5000 fee per tax return applies. Poll taxes are administratively cheap because. Must contain at least 4 different symbols.

They pay with no deductible for all inpatient and outpatient treatment. 301116 was a form of the poll tax. Applicable tax-exempt organization For purposes of this subchapter the term applicable tax-exempt organization means any organization which without regard to any excess benefit would be described in paragraph 3 4 or 29 of section 501c and exempt from tax under section 501a and.

For example if your claim amount is Rs. All corporations must have a distinctive element and in most filing jurisdictions a legal ending to their names. ASCII characters only characters found on a standard US keyboard.

One of the earliest taxes mentioned in the Bible of a half-shekel per annum from each adult Jew Ex. This amount is inversely proportional to your premium. 1040 If you file a return let me give you a free.

Over 500000 Words Free. With an annual turnover of at least EUR 15 million. 3000 and the claim will be worth Rs17000.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. Online trade commissions are 000 for US.

Important Details about Free Filing for Simple Tax Returns If you have a simple tax return you can file with TurboTax Free Edition TurboTax Live Basic or TurboTax Live Full Service Basic. Come and visit our site already thousands of classified ads await you. To which a taxpayer complies or fails to comply with the tax rules of his country for example by declaring income filing a return and paying the tax due in a timely.

If you intend to claim certain expenses against your tax it is advisable that you bring this up to discuss with your tax accountant. Statistical reporting to NBB for members of a large VAT group ie. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

A registration fee is due which is usually between 25 and 1000 depending on the state. The form and instructions are available on IRSgov. 3000 then you have to bear the first Rs.

Periodical employee contributions come directly out of their paychecks and may be matched by the employerThis legal option is what makes 401k plans attractive to employees and many. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. The non-resident investor applies the loss and can claim any resulting refund by filing Form T1262 Part XIII2 Tax Return for Non-Residents Investments in Canadian Mutual Funds.

The penalty is 5 of your balance owing for 2021 plus 1 of your balance owing for each full month that your return is late to a maximum of 12 months. 6 to 30 characters long. This means a foreign currency account can save you up to 75 on the transfer fee compared to a standard SWIFT transfer in THB.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Tax Accounting. An entity which provides insurance is known as an insurer insurance company.

Its easy to use no lengthy sign-ups and 100 free. 20000 and the voluntary deductible is Rs. What are you waiting for.

Engine as all of the big players - But without the insane monthly fees and word limits. Tool requires no monthly subscription. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

OR FEE -- Annual duties payable for the privilege of carrying on a. If you owe recovery tax for 2021 line 48500 of your return and file your return late the CRA will charge you a late-filing penalty. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing.

Form 1120 -1065 - Sch C - F - E - If you own a business or want to start a business let me merge those to help you through all the new tax laws. Content Writer 247 Our private AI. Social security contributions are deductible in determining taxable.

Indirect Tax Kpmg United States

Malaysia Payroll And Tax Activpayroll

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng Co Group

Tax And Secretarial Fee Tax Deduction Malaysia 2020 Dec 31 2020 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Capital Asset Costs Are Not Deductible As Business Expenses Wolters Kluwer

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Taxes For Bloggers How To File Taxes On Your Blogging Income 2022

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Tax Deduction Of Secretarial Fees And Tax Filing Fees

Causes And Effects Of Failure To File Annual Returns In Developing Countries Based On The Theory Of Planned Behavior And Economic Deterrence Theory

Business Tax Deadline In 2022 For Small Businesses

Taiwan Tax Faq Foreigners In Taiwan 外國人在臺灣

7 Tax Season Tips For Cleaning Businesses Insureon

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng Co Group

Write Off Your Marketing Expenses And Save Money On Your Taxes

Are Property Management Fees Tax Deductible And Other Tax Questions Answered

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)

Comments

Post a Comment